Elevation Land Investment Strategy

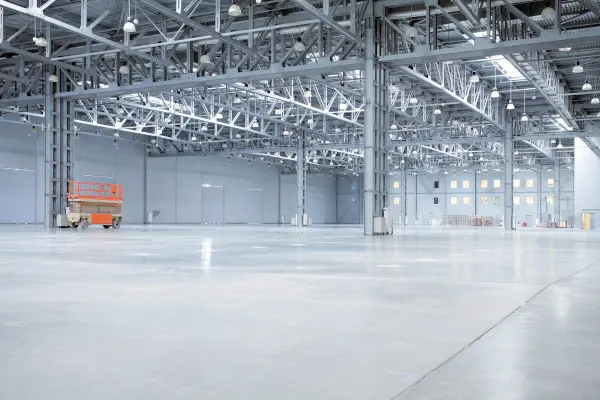

We are a commercial real estate investment and operating venture focused on opportunistic acquisitions of R&D, industrial, and life science assets in California and in high-growth markets in the Rocky Mountain States. We look for investment opportunities in high-barrier to entry locations and sub-markets that have long-term job formation characteristics, population growth, and strategic industry clusters.

Profitable Partnerships

We aim to acquire “value-add” investment opportunities in partnership with high-net-worth investors and institutional equity capital, where the asset’s potential upside can be realized through the following:

- Entitlement

- Development

- Capital Improvements

- Capital Stack Restructuring

- Superior Leasing and Management

What We Look For

Our company looks for “off-market” transactions with compelling seller circumstances and transaction characteristics that provide an opportunity to add value. We look to maximize the value of our assets and produce high-risk adjusted returns through a disciplined strategy. Typical structures we seek are:

- “Covered” land acquisitions

- Corporate excess property

- Land in need of entitlements

- Existing buildings that can be renovated, repurposed, or converted to alternative uses

Investment Criteria

Elevation Land Company focuses on risk-adjusted, value-add investments that meet the following general criteria:

- Geography - Western US, with a focus on California and the high-growth markets in the Southwest and Rocky Mountain region.

- Size - $5MM to $50MM equity placement

- Property Type - industrial, R&D, life science, land

- Risk Profile –“value-add”, entitlement, ground-up industrial development